No thanks!

How do I deal with client objections?

Your reply

I understand perfectly, but in today’s world opportunities for returns exist only if you are willing to take some risk.

Compare this with a job that advances your career. Any change in professional status is always a risk. Will the job deliver on its promises? What will my new colleagues be like? These are questions that everyone asks.

What is important is that the risk you assume matches your risk tolerance and that you are consciously assuming that risk. It’s not easy to take that first step, but that’s why we’re here at your side.

I would like to show you how to make your assets grow.

Your reply

Well, you can. But guarantees come at a price. When buying a smartphone, for example, many people take out an additional guarantee. And pay good money for it.

In theory, the same goes for investing money. What would happen if, say, you invested 1,000 Swiss francs in a safe 10-year Swiss government bond? You would end up with less than you started with. Because the security guarantee would cost you 10 francs a year.

That means that too much security makes you forego a potential return or you might even get back less money than you initially had. So think about how you can achieve an appropriate return without taking on too much risk.

Fortunately, there are ways. I will be glad to show you our solutions, which offer attractive long-term returns at reasonable risk.

Your reply

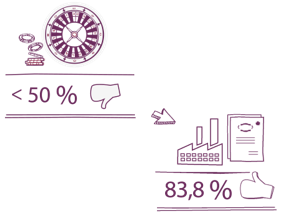

When it comes to your assets, we don’t rely simply on good luck. Quite the contrary: By investing in a fund you are actually holding something of concrete value. Your money will be invested in companies, for example. Together with other investors, you will own a piece of this company. When the company’s value rises, the value of your fund shares also rise, and vice versa.

Our fund managers ensure that your fund investment is as robust as possible. For example, in analysing whether investing in a company is worthwhile. This decision is based on various critieria, such as the company’s size, its strengths and weaknesses, its product range, its innovativeness, its competition, the impression made during an on-site visit and many other aspects.

You see? Funds have absolutely nothing to do with gambling. On the contrary, they are based on a well-thought-out strategy. Your chances of winning at roulette: Under 50%. Your chances for positive returns from a 10-year+ equity investment: 83,8%

Source: Bloomberg inhouse company calculations from 1897 to 20.5.2015. Index: Dow Jones Industrial. Past performance is not a reliable indicator for future results.

Your reply

Of course, that is highly regrettable, but you shouldn’t draw conclusions about all funds based on your experience with one. Equity funds, for example, invest assets exclusively in one type of investment – stocks. Such focus can lead to wide swings in value. The same thing can then happen to an investor as to a gardner who plants only one type of fruit. In some years the harvest will be good, but in others less so.

We therefore recommend you take out a multi-asset fund that is broadly diversified. Multi-asset funds usually offer better protection against swings in value. Our modern multi-asset funds offer, so to speak, all kins of fruit – the funds invest in equities and bonds from a wide variety of regions and sectors. This helps you both reduce risk and tap into opportunties in several asset classes.

Interested? Then I will be glad to introduce your to, for example, our Allianz Strategy Funds.

Interested? Then I will be glad to introduce your to, for example, our Allianz Strategy Funds.

Your reply

Allow me to compare this to a good meal. Just as a good chef will use only the best ingredients, our fund managers choose only the highest-quality stocks and bonds. Our fund managers combine different asset classes in such a way that they complement one another.

Allow me to compare this to a good meal. Just as a good chef will use only the best ingredients, our fund managers choose only the highest-quality stocks and bonds. Our fund managers combine different asset classes in such a way that they complement one another.

Allow me to compare this to a good meal. Just as a good chef will use only the best ingredients, our fund managers choose only the highest-quality stocks and bonds. Our fund managers combine different asset classes in such a way that they complement one another.

What is behavioural finance?

The fundamental theory of behavioral finance states that investors are subject to “distortions” that affect their reasoning. This means that they adopt models or behavioural biases that are impossible (or difficult) to explain rationally.

These behavioral biases influence their investment decisions and can have consequences on financial market fluctuations. If you know these behaviors, you can help your clients to overcome them.