Here are some arguments to keep saving:

Long-term price trends: Your client has a long-term investment horizon. Losses have almost always been made up in the past.

Fund savers are well placed: Fund savers buy more units when prices fall and so can get back in the black faster.

Broad diversification: The blend of asset classes can cushion individual losses.

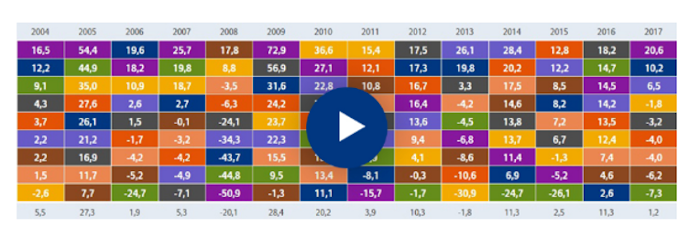

Long-term price trends

A look at the long-term performance of the worldwide equity market. shows that markets are always fluctuating. Yet in retrospect the general long-term trend has been upwards. So, if your client has taken a long-term view, there’s no reason to get upset over temporary price declines.

Lorem ipsum dolor sit amet

Fund savers are well placed

By investing the same amount on a regular basis your client buys fund units at various prices. When prices go up, he/she gets fewer units; when prices go down, he/she gets more units. So in a normally fluctuating market environment, your client benefits from a favorable average purchase price for your units (the so-called “cost-average effect”). Of course, timing is very important when selling your units.

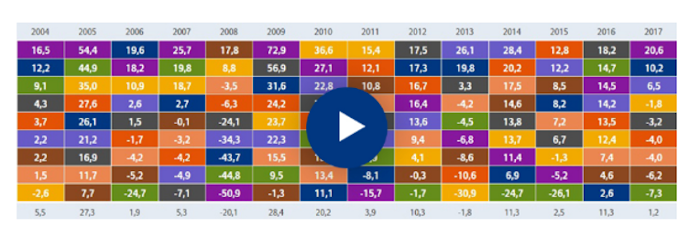

Diversification

If your client invests in a single asset class, he could have good luck or bad luck. What works well one year could perform badly the next. A combination of various asset classes produces losses less often and enhances the opportunities for returns.

Lorem ipsum dolor sit amet